excise tax rate nc

To calculate your tax liability in North Carolina all you need to do is multiply your North Carolina taxable income by 525. Excise TaxRevenue Stamps.

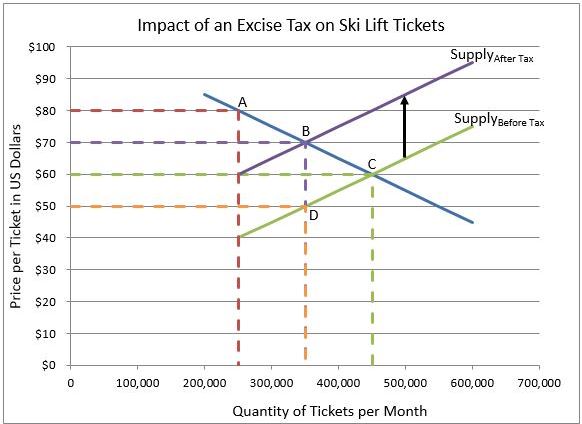

Definition Of An Excise Tax Higher Rock Education

The North Carolina use tax is a special excise tax assessed on property purchased for use in North.

. The State of North Carolina charges an excise tax on home sales of 200 per 100000 of the sales price. Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax. Imposition of excise tax.

For example a 600 transfer tax would be imposed. Exemptions from Highway-Use Tax. North Carolina County Tax Offices.

The transferor grantor seller buys the tax stamp from the Register of Deeds of the county in which the land that is being sold lies. Excise TaxRevenue Stamps. 2013 nc tax expenditure database.

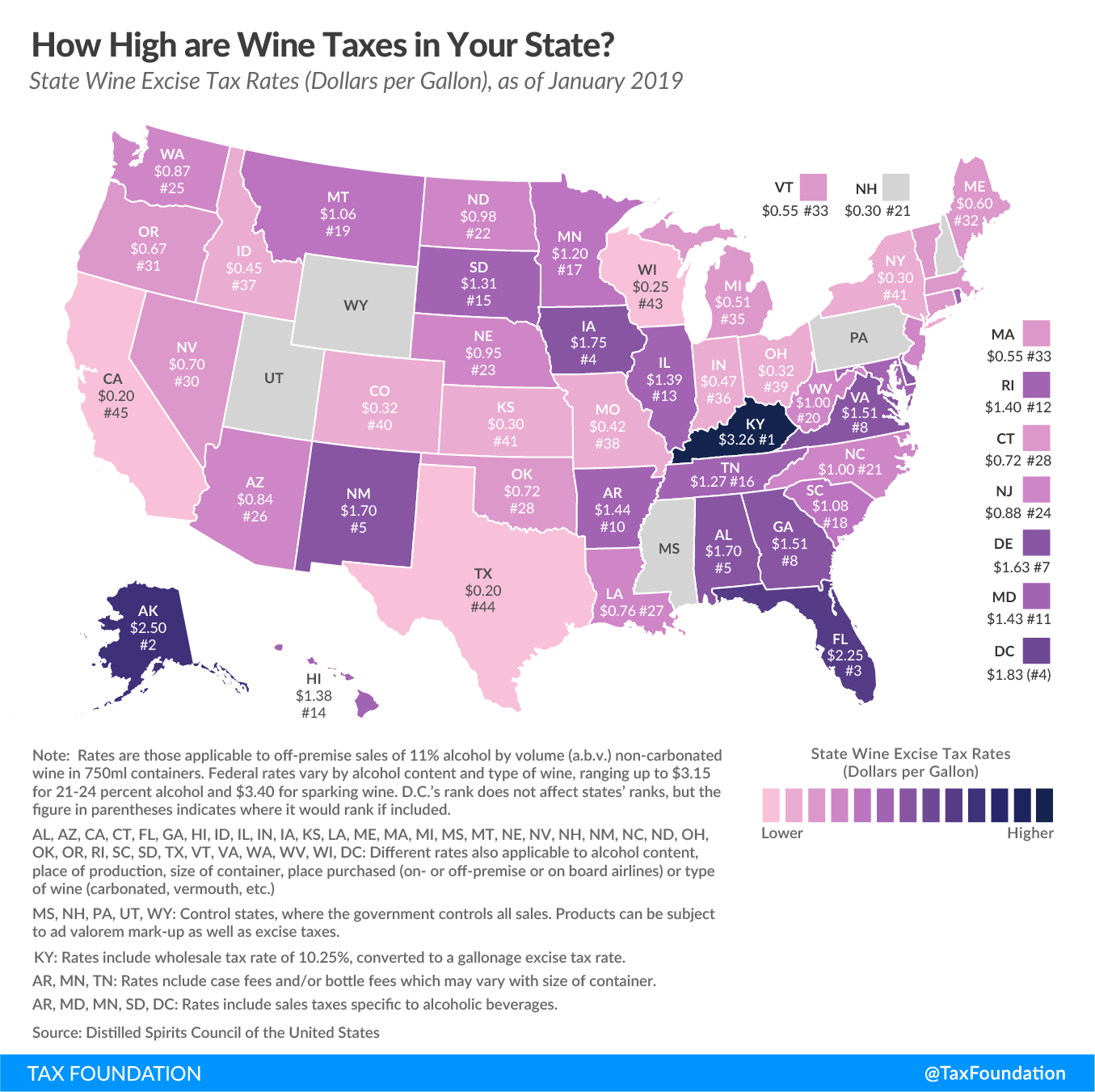

The State of North Carolina charges an excise tax on home sales of 200 per 100000 of the sales price. 2016 Alcoholic Beverages Tax Tehcnical Bulletin. The state sales tax rate in North Carolina for tax year 2015 was 475 percent.

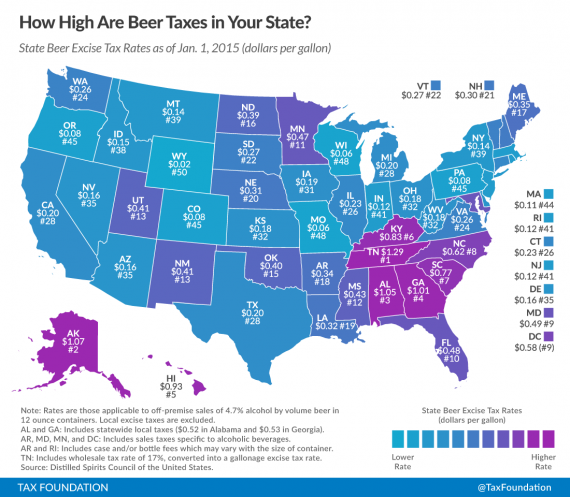

North Carolina Beer Tax - 062 gallon. The table below summarizes state sales tax rates for North Carolina and neighboring states in 2015. The standard North Carolina income tax rate is 525.

Appointments are recommended and walk-ins. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Imposition of excise tax.

North Carolina applies a 005milliliter tax. The North Carolina excise tax on gasoline is 3750 per gallon one of the highest gas taxes in the country. In North Carolina beer vendors are responsible for paying a state.

2022 North Carolina state use tax. Vehicle Property Taxes. 2016 Privilege License Tax Technical Bulletin.

Back to top Contact NCDMV Customer Service 919 715-7000. The NC use tax only applies to certain purchases. This title insurance calculator will also.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. In North Carolina other tobacco products are subject to a state excise tax of 1280 wholesale price as well as federal excise taxes listed below. Customarily called excise tax or revenue stamps.

North Carolinas excise tax on gasoline is ranked 6 out of the 50 states. North Carolinas general sales tax of 475 also applies to the purchase of beer. The tax rate is one dollar.

The rate of tax is 1 on each 500 or fractional part. Excise tax is customarily paid by the. The tax rate is one dollar.

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Excise tax is customarily paid by the. The North Carolina gas tax is included in the pump price at all gas stations in North Carolina.

2016 Piped Natural Gas Tax Technical Bulletin. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property.

North Carolina Might Cut Taxes On Income Cigars Cemeteries Vaccines

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

North Carolina Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022

North Carolina Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022

North Carolina Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022

State Wine Excise Tax Map Per Taxfoundation Org As Of Jan 2019 Bevology Blog Oh Pinions

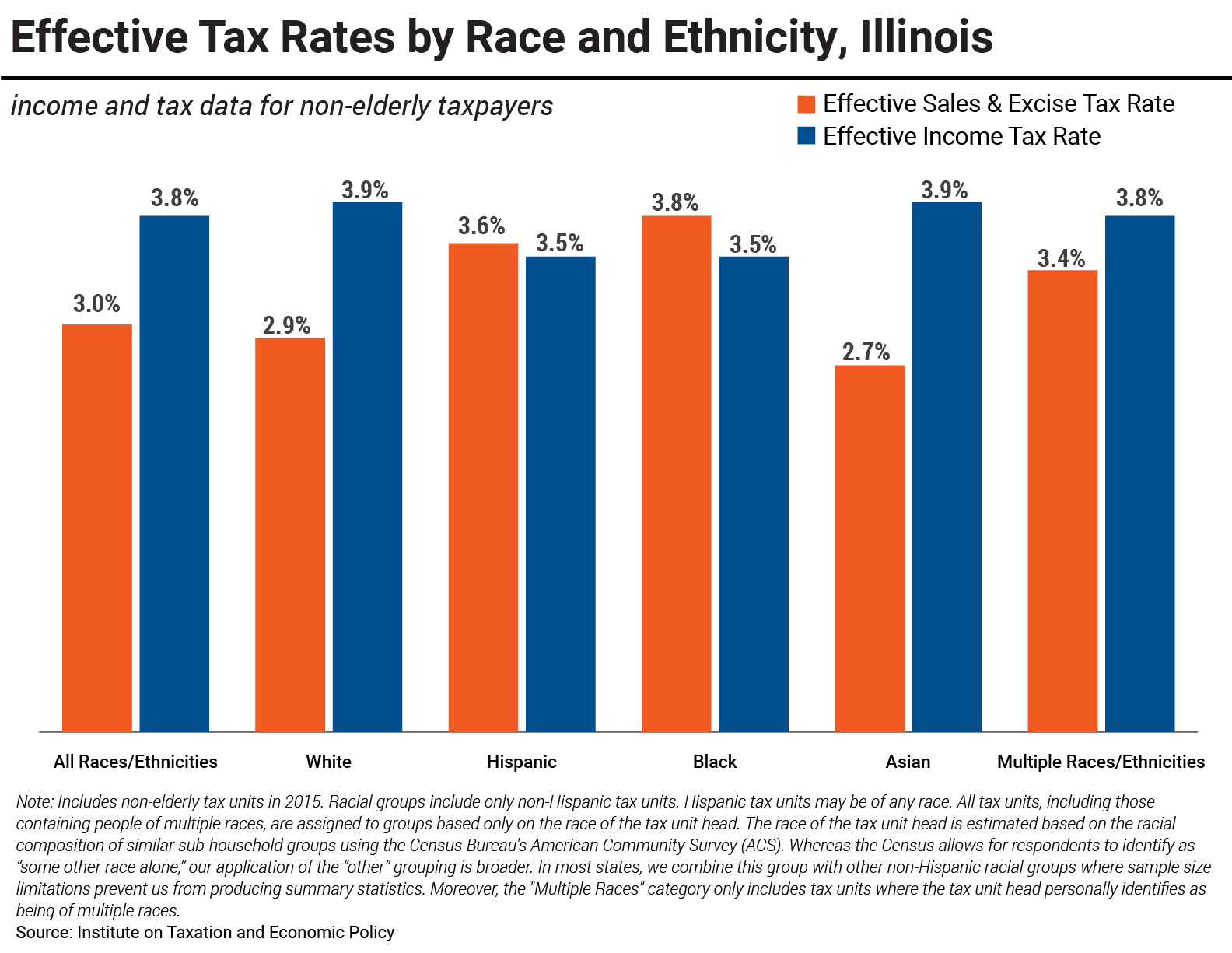

State Tax Codes Racial Inequities An Illinois Case Study Itep

Excise Taxes Excise Tax Trends Tax Foundation

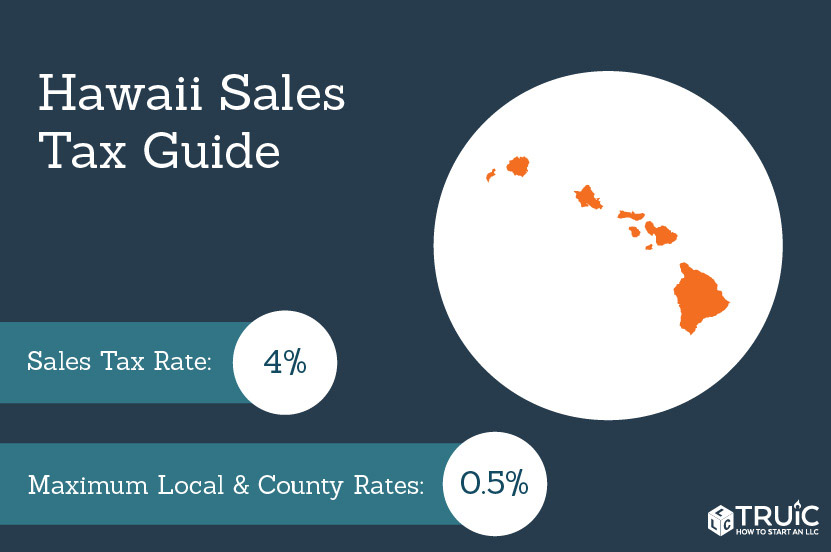

Hawaii General Excise Tax Small Business Guide Truic

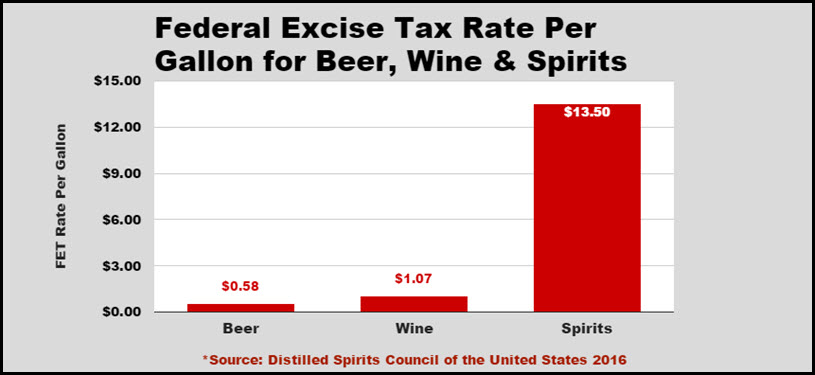

Part 1 The Distilled Spirits Federal Excise Tax Rate Is 1162 And 2228 Higher Than Wine And Beer Distillery Trail

State Recreational Marijuana Taxes 2021 Tax Foundation

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

What Is The Gas Tax Rate Per Gallon In Your State Itep

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

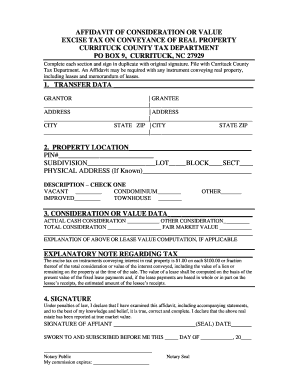

Affidavit Consideration Excise Tax Property Form Fill Out And Sign Printable Pdf Template Signnow